does tennessee have estate or inheritance tax

Inheritance tax is imposed on the value of the decedents estate that exceeds the exemption amount applicable to the decedents year of death. Tennessee is an inheritance tax and estate tax-free state.

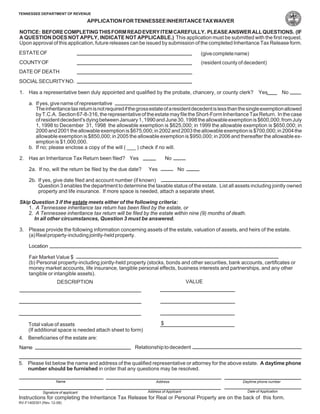

A Guide To Tennessee Inheritance And Estate Taxes

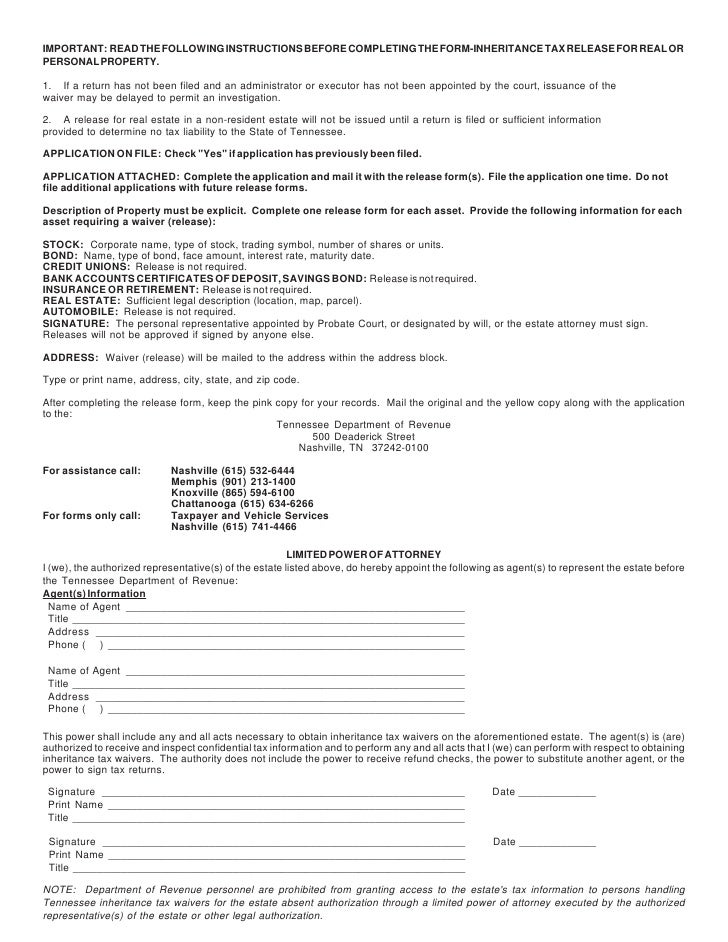

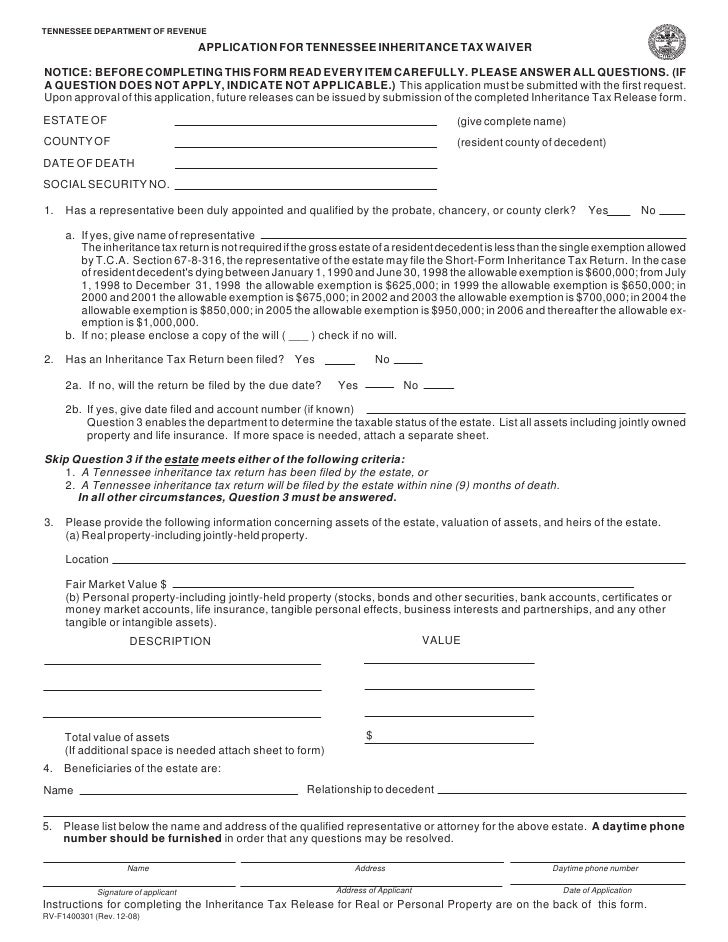

For all other estates subject to the inheritance tax for deaths that occurred before December 31 2015 the inheritance tax is paid by the executor administrator or trustee and it is paid out of.

. In 2015 the Tennessee estate tax applied to high value estates that were worth more than 5 million. Also estates of nonresidents holding property in Tennessee must file an inheritance tax return INH 301. What Tennessee called an inheritance tax was really a state estate taxthat is a tax imposed only when the total value of an estate exceeds a certain value.

No estate tax or inheritance tax. Most states have been moving away from estate or inheritance taxes or have raised their exemption levels as. Twelve states and the District of Columbia collect an estate tax at the state level as of 2019.

However in Florida the inheritance tax rate is zero as Florida does not actually have an inheritance tax also called an estate tax or death tax. There is no inheritance tax in Tennessee this would be tax that falls on the heirs and beneficiaries not on the estate of the person who died. The tax return and payment are due nine months after the estate owners date of death.

The inheritance tax in Florida is the legal rate at which the state of Florida taxes the estate of a deceased person. If you need more time to file use federal Form 4768 for a six-month extension. In 2012 the Tennessee General Assembly chose to phase out the states inheritance tax over a period of several years.

If the value of the gross estate is below the exemption allowed for the year of death an inheritance tax return is not required. Florida residents and their heirs will not owe any estate taxes or. Those who handle your estate following your death though do have some other tax returns to take care of such as.

When other states refer to inheritance taxes they are not referring to the total value of an estate. Indiana repealed its inheritance tax in 2013. No estate tax or inheritance tax.

Prior to July 1 2007 Virginia had an estate tax that was equal to the federal credit for state death taxes. No estate tax or inheritance tax. Recently states have moved away from these taxes or raised the exemption levels.

Tennessee is an inheritance tax and estate tax-free state. Indiana Ohio and North Carolina had estate taxes but they were repealed in 2013. The top estate tax rate is 16 percent exemption threshold.

No estate tax or inheritance tax. Maryland is the only state to impose both. The legislature set forth an exemption schedule for the tax with incremental increases for the exemptions until it is completely eliminated in 2016.

Estate transfer tax is imposed when assets are transferred from the estate to heirs and beneficiaries. Under Tennessee law the tax kicked in if your estate all the property you own at your death had a. For example the neighboring state of Kentucky does have an inheritance tax.

No estate tax or inheritance tax. For any decedents who passed away after January 1 2016 the inheritance tax no longer applies to their estates. There is a 1170 million exemption for the federal estate tax in 2021 going up to 1206 million in 2022.

Those who handle your estate following your death though do have some other tax returns to take care of such as. The maximum Tennessee estate tax rate was 95 which is significantly lower than the federal maximum rate of 40. The net estate is the fair market value of all assets less any allowable deductions such as property passing to a surviving spouse debts and administrative expenses.

The rates start at 10 and go to 20. An inheritance tax is a tax based on what a beneficiary actually receives from an estate. Today Virginia no longer has an estate tax or inheritance tax.

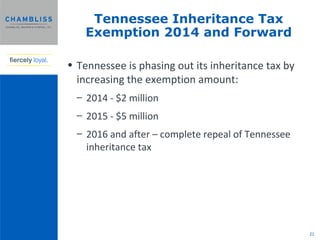

Under Tennessee law the inheritance tax was actually an estate tax a tax that was imposed on estates that were valued over a certain dollar amount. However certain remainder interests are still subject to the inheritance tax. The Tennessee Inheritance Tax exemption is steadily increasing to 2 million in 2014 to 5 million in 2015 and in 2016 therell be no inheritance tax.

The estate tax exemption amount in Hawaii is 549 million. However if the estate is undergoing probate a short form inheritance tax return INH 302 is required. No estate tax or inheritance tax.

Final individual federal and state income tax returns each due by tax day of the year following the individuals death. In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax. Unfortunately Hawaii does have an estate tax.

Though Tennessee has no estate tax there is a federal estate tax that may apply to you if your estate is of sufficient value. Final individual federal and state income tax returns each due by tax day of the year following the individuals death. Until this estate tax is phased out the minimum tax rate for estates larger than the exemption amount is 55 and the maximum remains 95.

As of December 31 2015 the inheritance tax was eliminated in Tennessee. The estate tax is progressive which means that the rates will increase as the estate size increases. Tennessee followed suit in 2016 and New Jersey and Delaware eliminated their estate taxes as of 2018.

Tennessee repealed its estate tax in 2016. Oklahoma and Kansas have also repealed their estate taxes. Twelve states and Washington DC.

Technically Tennessee residents dont have to pay the inheritance tax. The inheritance tax is paid out of the estate by the executor. Impose estate taxes and six impose inheritance taxes.

With the elimination of the federal credit the Virginia estate tax was effectively repealed. However it applies only to the estate physically located and transferred within the state between Tennessee residents. For instance if Mom and Dad die with 3000000 in their estate but they have three children who each inherit 13 of that estate 1000000 then each of the children may pay an inheritance tax on the 1000000 received if they live in a state which.

The inheritance tax is levied on an estate when a person passes away. It means that even if you are a Tennessee resident but have an estate in. New York raised its exemption level to 525 million this year and.

The federal exemption is portable for married couples. This doesnt extend your time to pay. On January 1 2020 Hawaii increased the tax rate on estates valued at over 10 million to 20.

Tennessee Inheritance Laws What You Should Know Smartasset

Fill In State Inheritance Tax Return Short Form

Here Are The 10 Best Cities In Wyoming To Retire In Wyoming Cities Wyoming Wyoming Travel

A Guide To Tennessee Inheritance And Estate Taxes

The 35 Fastest Growing Cities In America City Houses In America Murfreesboro Tennessee

Tennessee Inheritance Laws What You Should Know Smartasset

A Guide To Tennessee Inheritance And Estate Taxes

Tennessee Last Will And Testament Template Download Printable Pdf Templateroller

A Guide To Tennessee Inheritance And Estate Taxes

Tennessee Inheritance Laws What You Should Know Smartasset

Probate Fees In Tennessee Updated 2021 Trust Will

State By State Guide To Taxes On Retirees Tennessee Gas Tax Inheritance Tax Income Tax

Chambliss 2014 Estate Planning Seminar Pptx

The Surviving Spouse Estate Tax Trap When Someone Dies Estate Tax Inheritance Tax